Investing in real estate - the pros and cons of investing in real estate + an overview of the TOP 18 ways to profitably invest money

Hello dear readers of the financial magazine Rich Pro! Today we’ll talk about investing in real estate.

From this publication you will learn:

- What are the advantages and disadvantages of this type of investment;

- Various options for real estate investments;

- Features of investment in construction;

- How to start investing with a small amount of free funds.

In addition, at the end of the article you will find answers to frequently asked questions.

The article will be liked and will be useful both for those who are just looking for ways to invest their own funds, and for experienced investors. Do not waste time, start reading. And perhaps in the near future you will take the first steps to a successful investment in real estate.

What are the main pros (+) and cons (-) of real estate investments, which real estate is best to invest your money in, what are the ways to profit from this type of investment - more on this and more

What are the main pros (+) and cons (-) of real estate investments, which real estate is best to invest your money in, what are the ways to profit from this type of investment - more on this and more

1. Pros and cons of real estate investments - the main advantages and disadvantages

Each adequate person thinks about profitable investments. It is important that the investment saves money from the harmful effects inflation. It is desirable that the invested funds work, bring additional income.

To achieve the above goals will help investment instruments used for a long time period. At the same time, it is important that they have minimal risk and are very promising. These are exactly what they are real estate investment.

The need for housing in humans arose many years ago and has survived to this day. She will not go anywhere in the future. Therefore real estate always will be in demand, which means that it is great investment tool.

Moreover, such investments are a perfectly acceptable option for doing business. For this, it is not necessary to have huge sums of money. You can still invest in real estate at the initial stage of construction. In addition, there is the opportunity to become a member of the housing cooperative by buying a share in it.

Like any other financial instrument, real estate investment has prosand minuses.

Among the advantages (+) of this type of investment are the following:

- real estate has high liquidity;

- for a long period, constant profitability, egBy renting out the purchased property, you can make a profit for many years;

- relative availability of investments;

- wide selection of investment options.

Despite the significant advantages of real estate investments, they, like all existing investment options, are at risk.

The main disadvantages (-) of such investments are:

- demand for real estate is quite tangible depending on the economic situation in the country as a whole and in a particular region in particular;

- property prices are quite high;

- in small towns, real estate demand is quite low;

- high additional costs - utilities, repairs, taxes.

Moreover, there is an opportunity force majeure. It happens that the price of a property drops sharply due to insurmountable circumstances. for example, apartments in an ecologically clean area will become cheaper if a plant or a busy highway are built nearby. As a result, the investor not only does not earn anything, but it is also possible to lose part of the invested money.

To avoid most of the problems, it is important to conduct preliminary analysis. During it, possible options for investing are compared and various factors and circumstances that can affect the value of real estate are studied.

Popular options where to invest

Popular options where to invest

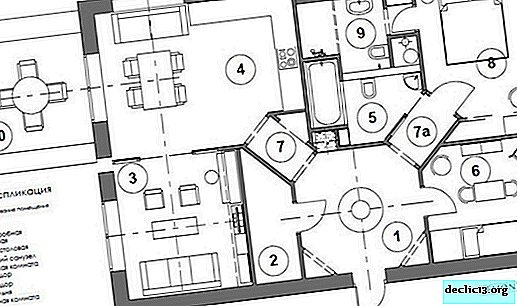

2. What real estate is profitable to invest money in - 8 popular options + comparative table

Investment experts believe that real estate investments are much less risky than trading on the stock exchange, investing in startups and businesses. The reason is simple: real estate is very rarely cheaper.

It is most profitable to invest in real estate in major cities. This is especially true for residential premises. In this case, a direct relationship is valid: the larger the city, the more profitable it is to invest in real estate. This fact is connected, first of all, with the difference in liquidity for it in different cities.

But it is important to understand that in each locality you can find your own suitable real estate for investment. To get the maximum profit, you should conduct a thorough analysis of all existing areas and choose the most profitable one.

Option 1. Residential Property

This option is most available. private investors. The risk of investment in residential real estate is minimal.

There are two ways to make money on the purchase of residential real estate:

- purchase for the purpose of subsequent resale at a higher cost;

- acquisition for renting out.

In any case, when buying an apartment, it is important to pay attention to the following criteria:

- location - in a prestigious, bedroom or student area, environmentally friendly, remote from the city center;

- floor plan, including the presence of a balcony, combined or separate bathroom;

- state - availability and quality of repair;

- infrastructure - how far are kindergartens, schools, clinics, public transport stops, shops.

In general, any, even seemingly insignificant criterion may be important for buyers:

- view from the window;

- floor;

- neighbors;

- contingent of the area of location.

To buy an apartment (or another residential property) as profitable as possible, you will have to look for it independentlywithout the help of a realtor. However, it is important to check the purity of the transaction. We talked about how to do this and what you need to know when buying an apartment in the primary and secondary housing markets in the last issue.

Option 2. Commercial property

This option for more experienced investors. For such investments, both office and retail space of a small size, as well as buildings of a large area, designed to accommodate warehouses, supermarkets, production shops, are suitable.

Such premises are invariably quite in demand. A huge number of businessmen are looking for areas to conduct business and are ready to give their owner rent. Those who purchase commercial real estate, it remains to regularly make a profit on their investments.

Rent is a classic option for obtaining passive income. The investor’s profit in this case does not depend on the time spent on work.

It is useful for an investor to know that when choosing commercial property as an investment object, it is required to have a sufficiently large sum of money. Contributions in this direction usually begin with five-seven million rubles.

Option 3. Land

For the acquisition of land requires a smaller amount of money than for the purchase of an apartment or commercial property.

There are a number of advantages of investing in land:

- minimum level of probability of fraud;

- no repairs required;

- lack of payment for utilities;

- the purchase procedure is easier than for other real estate;

- relatively low taxes;

- simple design;

- there is no need to resort to the help of realtors.

All land can be classified according to the purpose of use. For short term investments with minimal costs, the areas that are used are most suitable for construction. More long-term investments worth making in land intended for use in agriculture and industry.

But there is also limitations investing in land. Firstly, the state has tightened control over the use of land in accordance with its intended use. Besides, taxes on this type of property have recently been raised.

Option 4. Country real estate

Purchase of suburban real estate with a view to its further resale stably profitable occupation. This is especially true for large cities due to the fact that more and more often their residents are trying to settle down or have the opportunity to relax as far as possible from city noise and dirty air.

There are several options for investing in suburban real estate:

- acquisition of facilities under construction;

- investment in finished cottages;

- purchase of land intended for the construction of suburban real estate.

The prospect of investing in suburban real estate increases over time. But when choosing an object to buy, you should pay attention on its location, available infrastructure and communications. Other factors important for creating comfortable living conditions can be of great importance.

Option 5. Real estate under construction

Another investment option is to invest in real estate under construction (new buildings). Despite the fact that the riskiness of this option is somewhat higher, but you can also get much big profit.

The explanation is very simple - a property under construction is much less than in the secondary market. Therefore, if you invest at the initial stage, after the construction is completed, the prices are likely to be significantly will grow. As a result, the investor will receive tangible profits.

Risks when investing in real estate under construction are most often associated with the developer. If it is unreliable, it rises risk occurrence of the following situations:

- untimely commissioning of the property;

- complete freezing of the construction site;

- in case of illegal construction or the absence of permits, a complete demolition of the structure is possible.

That is why, before investing in real estate under construction, the investor needs to conduct a thorough analysis of the developer.

It is important to study not only the company's reputation, but also the following characteristics:

- company lifetime;

- the number of completed and commissioned facilities;

- whether there were downtime during the construction process in the past, their duration and causes.

About how to buy an apartment from a developer in a new building (a house under construction), read in a special issue.

Other real estate investment options

The above investment options are the most popular. There are other methods that are no less promising, and therefore also deserve attention.

Option 6. Investments in parking spaces

This type of investment is relevant. for large cities. The amount required for investment in this case is relatively small. Parking spaces are constantly required by drivers, so the demand for their rental does not dry out.

Moreover, fines for parking in prohibited places are steadily increasing; cars are increasingly being taken away by tow truck. Therefore, parking will always be in demand. However, it is difficult in this case to predict the potential income, since statistics on such investments are not available.

Option 7.Participation in real estate funds

I mean acquisition of shares any fund investing in real estate.

The advantages of this method of investing are as follows:

- the property is not registered as an investor, which is often very convenient;

- directly engaged in investments professionalswho have developed a certain basis for investing funds;

- high degree of diversification.

The above advantages allow the investor to be confident in the high return on investment.

Option 8. Investing in foreign real estate

Investments in real estate located in other states are usually considered a guaranteed way of investing. for example, residential real estate rarely becomes cheaper regardless of its location. Moreover, it can be regarded as an option for a future move. That is why most experts consider such investments to be a fairly profitable option, not without prospects.

To summarize, we summarize the above methods in a table, excluding additional optionsfor which there are few statistics. This will greatly simplify their comparison.

Comparison table of real estate investment options

| Option | Rate of return | Features of investing |

| 1) In residential property | Tall About 30-65% for 3-5 years | When acquiring a property for rent, you should count on long terms |

| 2) In commercial real estate | Tall | Investments should be made for the longest possible period. |

| 3) To the ground | Average | Minimum taxes Simpler acquisition scheme |

| 4) In suburban real estate | Tall | Profitability is highly dependent on location and infrastructure. |

| 5) In real estate under construction | Tall from25-30% for the duration of the project (from the stage of excavation to the commissioning of the facility) | Fairly high risk of loss of funds in case of improper choice of the developer |

The table shows that real estate investment is long term investing money with a fairly high yield. About other ways where you can invest to earn money, we talked about in one of our previous articles.

Profitable schemes (methods) of real estate investment

Profitable schemes (methods) of real estate investment

3. Real estate investing - TOP-18 ways to invest money

By investing money in real estate, you can earn income in a lot of ways. Some of them are obvious, others are not familiar to everyone. Let's try to systematize the maximum amount of information about possible earnings options.

3.1. Investing in real estate in order to obtain income from renting it out - 12 ways

One option is to buy a property and rent it out. There are several ways to generate income.

Method 1. Buy an apartment to rent it out for a long time.

This option is the most popular way to make money on real estate investments. Rent an apartment is not difficult, because there are a lot of people who want to rent a house. It is important that you can earn on relatively inexpensive real estate properties - rooms in a dormitory or even in an apartment. By the way, about how to make money on an apartment, read in one of our materials.

Plus such a method is that there is no need to exert a lot of effort. It is enough to choose suitable tenants, sign an agreement with them and receive money on a monthly basis.

However, this method also has significant minuses:

- low profit margin;

- if you buy an apartment with credit, it is unlikely that the rent will block the payment of a mortgage.

Such disadvantages do not matter if you did not have to invest in an apartment, egupon inheritance or privatization. If you buy real estate, this way it will pay for itself for a very long time.

Method 2. Acquisition of an apartment for the purpose of daily renting

This way of making a profit from real estate investment is more profitable. However, it requires quite a lot of effort: it will be necessary to show the apartment almost every day, evict and resettle new residents, do the cleaning, wash the linen and towels.

When renting an apartment, it is important to choose the right residents. Best if it will tourists or business trip. Such categories of citizens rent housing for a longer period - up to several weeks, as this is in any case more profitable than hotel accommodation. Typically, such tenants behave calmly, and there are no problems with them.

Renting an apartment for young people who want to have fun is less preferable. This is fraught with complaints of neighbors, spoiled furniture and repairs, smoke from smoke in the apartment.

If an investor decides to rent an apartment, you can advise him take a pledge in the amount of the cost of living. This will become insurance in case of damage to any property. It will also be useful to make a copy of your passport.

Advantage this way of investing is a higher level of profit.

Among disadvantages can be called:

- the likelihood of damage to furniture and other property;

- the need to often show the apartment, to settle and evict residents;

- regular cleaning and washing is required.

Method 3. Acquisition of an apartment with subsequent hourly rental

Specialists call this method of renting the most aggressive. Moreover, he is able to provide maximum profit.

With this option, residents will have to be resettled and evicted many times a day. Therefore, it is advisable to live or have an office next to the rented apartment.

It is important to be prepared for the fact that neighbors can begin to make complaints about the fact that strangers constantly go back and forth on the site.

There are several the benefits this way of renting:

- high profitability;

- with properly organized advertising there is a chance to rent an apartment almost around the clock.

However, there are a number of disadvantages of this option:

- the constant settlement of dubious individuals can lead to damage to property;

- you must always be near the apartment in order to regularly check and evict;

- dissatisfaction of neighbors;

- too frequent change of bed linen, as well as cleaning.

Method 4. Buying an apartment in order to organize a hostel

Hostel - a budget type of hotel, which is the provision of a bed for rent in a comfortable apartment.

It is necessary to have a high-quality renovation and all the amenities necessary for living. At the same time, 10-12 beds can be located in the apartment. Most often, this option of settlement is chosen by people who have arrived on a business trip, and tourists.

Hostels usually stop those who need to spend the night somewhere, but do not want to overpay for a daily apartment or hotel. Prices are much lower than with other rental options. They start from 500 rubles.

Benefits investing in hostels:

- high income if it was possible to ensure permanent residence of customers;

- even if some places are not populated, the hostel will be in a plus due to the large number of beds.

Minuses hostels:

- at the initial stage, you need to make a chic repair, which should be maintained at the proper level;

- bunk bed costs;

- claims from neighbors are possible;

- will have to devote a lot of time to advertising, checking in, cleaning;

- in order to be able to settle business trips, you will have to register an IP, since they need documents for reporting.

And yet, unfortunately, not so long ago a law was passed prohibiting the development of hostels in residential premises. Therefore, in order for the activity to be legal, you will have to buy an object commercial real estate.

Method 5. Leasing the acquired townhouse

Townhouse is a European housing option, the distinguishing features of which are a small number of storeys and maximum living comfort.

In addition, this type of housing is located away from densely populated areas of the city, there are few neighbors here. Most often these are villages located near the city, the outskirts of the city, and forests.

Renting townhouses stands apart from the delivery of apartments, because it has its own characteristics. This option can combine daily, hourly and monthly rents.

The benefits of this method are:

- the possibility of settling tenants of high social status;

- if desired, the housing object can be redeveloped by dividing into studios, and thereby increase the number of simultaneous tenants.

Among cons it can be noted that the demand for such real estate is much lower. Therefore, residents will have to look longer than usual.

Method 6. Investment in a cottage or a country house for rental

Owners of country houses and cottages rarely have problems with generating income from such real estate. You can donate them as per monthand by the day. For long-term leases, it is important that the distance to the city is small, and convenient transport interchanges are located nearby.

Investments in suburban real estate (cottage, private house, cottage) for subsequent rental

Investments in suburban real estate (cottage, private house, cottage) for subsequent rental

If the cottage is large enough, you can rent only part of it. In the second half, the owner can live by himself. Cases when real estate is rented only part of the year. for exampleIn summer, the owners live in the cottage themselves, and in winter they rent it out.

An excellent option for renting a cottage - on New year holidays. At this time, the excitement at the venue of the holiday does not cease. Many large companies dream of celebrating New Year in a cozy cottage, located in a beautiful place. You can also provide the opportunity to rent a cottage for corporate events.

Pros such earnings options are:

- stable high income;

- the ability to choose among a large number of options - from renting part of the cottage to renting only on holidays.

Disadvantages rental cottages can be called:

- the need for location in the immediate vicinity of the city;

- the availability of quality access roads.

Most in demand are small cottages with an area of up to 100 sq.m. Owners of much larger premises can be advised to lease them in parts. But here should provide for the presence of separate entrances to the building.

Method 7. Acquisition or construction of an apartment building and its rental

Those who have significant sums of money have already appreciated the possibility of investing in apartment buildings. And it’s quite realistic to organize such an option for making a profit when absolutely all apartments located in the house are rented.

Capital in this case is very significant. But you can save by building a budget housing, for example from LSTC (light steel thin-walled structures). In addition, you can increase the number of apartments if the whole house is divided into studios, which are also in greatest demand.

The maximum income can be obtained if you find a land plot with a convenient location for building a house.

Pros such an investment option is a big income. At the same time, significant monthly incomes are guaranteed even with incomplete check-in at home.

Among disadvantages The following can be distinguished:

- huge initial investment;

- often it’s not possible to quickly find a land plot for construction.

Method 8. Investing in foreign real estate for a guaranteed rental

Many believe that the overseas property market is more reliable and profitable. Therefore, it attracts various Russian investors from small before major.

Investors often raise the question of how to safely rent property abroad while living in Russia. The easiest option is guaranteed rental agreement with a management company (UK), in the role of which can be both developers and independent firms.

The contract for the management of real estate prescribes the cost of maintenance, as well as other obligations of the Criminal Code - from paying utility bills to the subsequent lease of the property.

The most favorable conditions offer in France, because it was there that this method arose.

The essence of the mechanism is as follows:

- investor acquires real estate;

- the apartment is being renovated, furniture is being bought;

- a subsidiary of a construction company rents out an apartment;

- the investor receives commissions that make up from 3 to 6 percent of the cost of the apartment per year, depending on the location of the property.

The advantage of this method is that the investor does not need to search for tenants. The management company also takes on all organizational issues.

The types of real estate that are available for purchase abroad are diverse. Here you can purchase:

- villas;

- mini-hotels;

- apartments;

- apartments by the sea;

- apart-hotels.

If you invest in real estate located in resort areas, you can be sure that it will not be empty. Moreover, the cost of such real estate is often much lower than in large Russian cities. A particularly significant difference is observed when comparing with Moscow.

Among pluses this investment option can be called:

- reliability;

- perspectives;

- the possibility of investment by any category of investors;

- in the case of a guaranteed rental, you can get passive income. Which is often higher than when renting other real estate.

Among difficulties can distinguish:

- the need for fluency in foreign languages;

- have to visit the country in which you plan to buy real estate at least once;

- it is difficult to find information about the legal and legislative features of foreign countries.

Method 9. Acquisition of a room in apartments in Russia and its subsequent lease

On the real estate market in Russia are gradually becoming more popular apartments. They are very similar to ordinary apartments with a finished interior. In addition, it provides traditional hotel services - concierges, food delivery and more.

TO pluses such investments include:

- lower cost compared to apartments of a similar size;

- high level of hotel service;

- usually highly developed infrastructure. Often in the building there are fitness rooms, restaurants, cafes, beauty salons;

- the apartments can be leased through the management company, the investor will not have to settle the residents himself.

Among disadvantages apartments can be distinguished as follows:

- low degree of regulation in the legislation;

- the apartments have the status of non-residential premises, so registration in them will not work;

- There are still few offers of apartments on the market.

Method 10. Acquisition and subsequent lease of commercial non-residential property

A separate point of real estate investment is purchase of commercial space. This can be a warm or cold warehouse, production facilities, premises in shopping and office centers, non-residential premises in residential buildings, plinths, basements and many other objects.

Investing in such real estate is popular because of the great demand for it. A huge number of businessmen daily look for new areas to conduct business. Their needs are different: one needs rooms with high traffic, the other - with a low rental cost.

pros investments in commercial real estate:

- stable profit;

- You can reduce rental payments for a while to keep tenants;

- variety of delivery options, for example, in parts;

- dependence of income on the size of areas, which can be hundreds or even thousands of square meters.

Among cons commercial real estate as an object of investment can be called:

- difficulty finding tenants over large areas;

- during crisis situations, problems with leasing are possible.

Method 11. Redevelopment and breakdown of the premises into separate isolated immovable objects of a smaller area for subsequent lease

The basis of this method is the creation of several isolated residential real estate on the area of one room. In other words, an investor, having one-room apartmentmay split her at 2 studios. As a result, the profit from the lease in comparison with the lease without changes increases at least one and a half times.

For redevelopment, apartments with one, two, three rooms, as well as cottages and a townhouse, are suitable. Difficulties may arise with the lawful conduct of such events. However, they are usually resolved.

Benefits Such a method consists in increasing profits by creating several isolated rooms.

disadvantages consist in the need for redevelopment and technically difficult repairs, as well as in the coordination of the changes.

Method 12. Buying a garage, box or car space for rental

This option is suitable for investors who wish to invest in real estate, but do not have a large amount of money.

Most often they buy garage boxes, parking lots, including underground ones, as well as garages.

Advantage this way is a low price entry. In some regions, for the acquisition of such immovable objects, it is enough to have about three hundred thousand rubles.

Significant disadvantage is low yield.

3.2. Investing in real estate for the purpose of further resale - 5 ways

You can earn by investing in real estate not only on lease, but also on sale. There are also several ways to do this.

Method 13. Acquisition of land for subsequent resale

This is one of the easiest ways to invest. It is enough to buy a land plot, wait for the price to rise and sell it. At the same time, it is not necessary to invest large funds and efforts on its maintenance.

In addition to resale, you can build a house, townhouse or cottage on the acquired land. After this property can be to sell or to rent.

The benefits such investment options are:

- a large selection of land for various purposes;

- if a subsequent sale is planned, a minimum of effort will be required.

disadvantages manifest when land is bought for construction. In this case, additional efforts and financial costs will be required.

Method 14. Buy an apartment at the time of construction, and when the house is commissioned, sell

With this method, real estate (often apartments) bought in the early stages of construction.

In this case, options are possible:

- buy real estate at the very beginning of construction, when there is only a foundation pit or lower floors;

- invest in later stages of construction.

There is a direct relationship. Than before purchased property big profit can be obtained after putting the house into operation. In some cases, the investor’s profit reaches up to 45-50% and more. But in order to get such income, you need to buy an apartment at least a year and a half before the end of construction.

It is important to take into account the high risk of unfinished, which is characteristic of our country. The chance to stay without an apartment is quite large. Therefore, it is safer and faster to make a profit by purchasing an apartment in the last stages of construction.

The benefits the considered method are:

- no need to search, move in and evict residents;

- income is closer to passive - it is enough to buy real estate at the construction stage, and when it is ready, sell it;

- the profit is quite high, as real estate and materials are constantly growing in price.

Disadvantage This option is a fairly high risk of unfinished.

Method 15. Acquisition of an apartment in poor condition, decoration and sale

In the modern world, the lower layers of the population often live in apartments, eg, alcoholics, drug addicts. Naturally, they have housing in poor condition. As a result, the apartment has disgusting plumbing, ragged walls, a terrible smell.

There are other apartments suitable for this method of investing. These are the so-called grandma's options - real estate in which pensioners lived for a long time who could not properly care for it. Most often, these include apartments in houses of the old buildings, which have been in operation for several decades.

Similar apartments attract investors. They can be bought at a very low cost, having made repairs, brought to a decent condition. After that, such an apartment can be sold at an average market price or even more expensive. (We talked about how to quickly sell an apartment and what documents are needed to sell it in a previous issue).

You can also use this property for different rental options.

Advantage Such an investment option is that by selling such an apartment after repair, you can get a significant profit. Moreover, you can rent it out with a regular passive income.

Disadvantages of this method are:

- the need for additional repair costs;

- the demand for dysfunctional apartments is much higher than the supply, many realtors are hunting for such real estate, so you can choose an option for a very long time.

Method 16. The purchase of real estate held in pledge or under arrest at a reduced price for the purpose of subsequent resale

Often, banks in the lending process take real estate as collateral. If the borrower is not able to pay the obligations undertaken, the encumbered property becomes the property of the bank. Credit institutions often try to sell former collateral as quickly as possible, reducing the price of them as much as possible.

Advantage This investment option is the possibility of acquiring real estate at prices much lower than market prices.

Among disadvantages this option can be called:

- the complexity of the bidding process, it will take time to figure everything out;

- it may take a long time to find the right property;

- You should regularly monitor announcements about such sales options;

- You can only buy such real estate in cash, mortgage loan schemes are not applied here.

Method 17. Building a house from scratch and selling it after readiness

This investment option is quite popular because land plots and real estate itself are becoming more expensive over time. A house built independently will cost less than an apartment of the same area, and the difference can reach 100%.

With this option, there is practically no risk of unfinished work. It lies only in the financial capabilities of the investor, which are best calculated immediately. Significantly reduce the amount of investment can those who have construction skills and several people assistants.

With the simultaneous construction of several houses, there is an opportunity to save on building materials. In addition, the initial capital can take on credit. There is a chance to get a mortgage for the construction of a country house.

Most often build houses and cottages. If there is a large amount, you can build townhouse or even small houses from several apartments.

The benefits This investment option has several:

- high profitability in case of success;

- the opportunity to use the house for their own purposes.

Among disadvantages can be called:

- the investor must understand all stages of construction;

- if the construction of the house is planned using hired workers, you will have to independently monitor the progress of construction.

3.3. Original (unusual) ways of investing

In addition to the above schemes for generating income from renting or reselling real estate, there are other ways to earn money on real estate investments. It can unusual ideas, for example, as an option below.

Method 18. Re-equipment of the sea container in the living room

For Russia, this type of suburban real estate is new. At its core, it resembles an ordinary cabins, but comfortably furnished. Such a house is the most affordable option. There is even no need to build anything here. It is enough to install the container, make high-quality repairs, extend communications.

When comfortable living conditions are achieved, in such a house you can live yourself or sell it. If motorways are located near the site, it’s quite possible rent such a house.

The cost of creating such housing is low. The container can be bought boo about behind 100 000 rubles. Repair work and communications will cost about another at 150 000 rubles. In principle, this is enough to get affordable housing.

It is curious that, if necessary, in the future such a house can be moved to a new place.

for example, acquired a plot on which the construction of a major house is planned. During the work you can live in a house from a container. When the construction is completed and the work is transferred to another site, the house can also be moved there.

If we talk about investor interest, a container house, if it is beautifully finished, it is possible to rent. Of course, such a rental is much cheaper than in a full-fledged house, but the demand for such housing will always be. This is due to the fact that many people are looking for accommodation as cheap as possible options.

This option is also suitable for those who buy land, but do not currently have the opportunity to begin construction. In this case, you can place a house from a container on the land plot, live in it yourself. If you rent such housing, you can save up for construction or repay a loan taken to purchase land.

Advantages Such an investment option is as follows:

- low cost of housing;

- You can create a creative interior, an unusual design outside the house.

Disadvantage is that not everyone agrees to live in a house from a container. However, if you apply maximum imagination and make the housing comfortable enough, there will be no end to tenants.

Thus, there are a lot of ways to make money on real estate. When choosing the right one, one should be guided by one's preferences, as well as the available capital.

A step-by-step guide for beginners and novice investors on real estate investing

A step-by-step guide for beginners and novice investors on real estate investing

4. How to start investing in real estate - 5 simple steps

Regardless of which way of earning is chosen, real estate investment should be consistent and prudent. This allows you to minimize the level of risk and maximize profit.

It is important to follow a certain sequence so that investments are comfortable and safe.

Step 1. Determine the level of financial opportunities

First of all, the investor must decide how much money does he have. This is what determines what type of property will be invested in.

It’s important to remember that you can invest free cash onlythat are not designed to pay for the vital needs of the investor.

If the investor’s capital is small, then you will have to choose from investments in land or housing during the construction phase. It is worth considering the options for increasing capital through borrowed funds and attracting co-investors.

Step 2. Examine offers

One of the most important stages of any investment is market analysis. The size of future profit depends on it.

To make a really profitable purchase, you need to spend quite a lot of time analyzing the current market situation.

Really big profit is usually received by those investors who are able to thoroughly study the trends and nuances of the market.

Step 3. Choosing an object for investment

Important choose the right propertyin which funds will be invested. Some investors with significant capital prefer to invest in luxury housing and various exclusive options. (eg, penthouses or apartments that have terraces). Such facilities cost significantly more, but they also have higher liquidity. This is especially true for large cities.

If a decision has been made to invest in facilities under construction, you should choose those that are under construction. in one step. The cost of such housing is constantly growing with the advent of new floors. Therefore, it is advisable to invest in such real estate at the earliest possible stage.

In terms of profit level, real estate in the secondary market less attractive for investors. But such housing can be bought on a mortgage and immediately leased.

Step 4. Buying a property

At this step, it is very important to correctly and cheaply carry out the procedure for registration of the property. Those investors who do not have sufficient experience in such purchases should seek help. lawyer or experienced realtor. He will help to correctly execute the transaction in accordance with the law.

Important also to remember about the tax nuances of the transaction. You should familiarize yourself with them in advance.

Step 5. Making a profit

To make a profit, it remains resell or to rent purchased property. In this case, the payback period depends on the objectives of the acquisition.

for exampleif the apartment, which is in a new building, is resold, income will be received in 2-3 years. But do not forget that with the sale of property owned less 5 years, you have to pay tax.

Rent represents more long term investments. Payback in this case will only come in 6-9 years. But at the same time, the risks of investing are much lower. Moreover, the leased property will remain the property of the investor. If necessary, it can always be sold.

The investor must understand that by making investments in sequence, moving from step to step, you can significantly reduce the level of risk and increase profitability.

Popular areas of investment in the construction of residential and commercial real estate + successive stages of competent investment

Popular areas of investment in the construction of residential and commercial real estate + successive stages of competent investment

5. Investments in real estate construction - 5 reliable options for investing + the main stages of investment

Investing in real estate under construction today is very popular. They are a great way to make money work. Therefore, it is so important to understand all the nuances and subtleties of this issue.

5.2. Which construction is better to invest in - TOP-5 options + comparison table

There are several different areas that allow you to invest money in real estate under construction. The choice depends on investor experience, as well as amount of invested capital.

Below are five of the most popular and least risky investment options in construction.

Option 1. Investment in housing (apartments) in houses under construction

This option is considered one of the most available investment methods inherent the minimum risks. The purpose of such investments is long-term - to acquire housing (apartment) at the construction stage, and when it is finished, to sell or to rent.

When choosing an object for acquisition, it is important to consider the following indicators:

- location - the distance to the nearest traffic intersections, public transport stops, metro stations;

- layout of the premises;

- infrastructure - whether there are schools, kindergartens, large shops in the immediate vicinity;

- prospects for the development of the region in the future.

It is also important to remember that small-sized apartments, with one or two rooms, are in the greatest demand in the market.

Option 2. Cottages (private houses)

Traditionally, cottages include houses and summer cottages that are located outside the city. Such a property can be quite profitable. Especially high demand for cottages in major cities. Their residents strive to provide themselves with the opportunity to relax away from the city bustle, dust, noise and gas pollution.

Investing in cottages at the foundation stage is considered the most promising.

When choosing an object for acquisition, you should pay attention to several indicators:

- district status;

- are there any communications;

- how developed is the infrastructure.

Other parameters may also matter, on which comfortable living depends.

Option 3. Hotels

The experience of investors around the world allows us to understand that the payback period of such investments is about 4-6 years. These are very good indicators.Moreover, in large cities there is always a demand for quality living quarters from visitors.

Option 4. Production facilities

This method of investing is most suitable for those investors who already have experience working with real estate. It is important to decide on the purpose of such an investment before the purchase of production facilities under construction.

The following objects are most in demand in this option:

- furniture factories;

- food industry facilities under construction;

- production of household chemicals and basic necessities.

Beginning investors are best invested in industrial real estate, using the services of professionals: mutual funds or management companies.

Option 5. Investment in commercial real estate

This is another option that is most suitable for experienced investors.

The following objects act as commercial real estate:

- trading premises - shopping centers, shops and supermarkets;

- restaurants, bars and other catering establishments;

- centers for entertainment, sports and education;

- office and business centers;

- warehouses, hangars, storages;

- agricultural premises.

For megacities, investments in office and retail space are characteristic. They are in high demand by businessmen looking for rental space. Owners of such objects, maintaining them in good condition, receive a stable profit.

Exactly rental considered the best way to make money on commercial real estate. This option is characterized by a large amount of initial investment and a long payback period (at least five years).

The table below helps to compare investment options for construction:

| Property Type | Features of investing | Payback period |

| 1) Residential buildings under construction / new buildings | If at the end of construction to lease real estate, the profit will increase, but the payback period will be higher | 1-2 of the year |

| 2) Private houses, summer residences, cottages | It is important to consider the location and infrastructure of the area | |

| 3) Hotel facilities | A promising option for megacities and resort areas | 4-6 years |

| 4) Production facilities | Suitable for mutual funds, i.e. collective investments | 8-10 years |

| 5) Commercial property | It is advisable to have experience investing in real estate | 6-9 years |

The table shows that the most interesting option for a private investor is housing investment, namely the purchase of apartments in new buildings for resale.

5.1. How profitable is it to invest in housing?

The average construction period is 2 years. During this time, the cost of living space in it increases approximately 45-75%.

It is beneficial for developers to raise funds from investors. This avoids bank loans and at the same time collects the amount needed to build a house. Therefore, at the start of sales, which usually occurs at the earliest stages of construction, the cost of housing minimal.

A particularly large difference in price is observed during the construction of microdistricts or rather large residential complexes. Such housing estates are being erected in stages. Developers set the minimum initial cost of apartments in order to attract the first wave of buyers, as well as create a positive image.

As a result, investing in real estate under construction, after putting the house into operation, you can get the amount double the initial investment. The only thing that may alert investors is riskthat construction will be suspended or completely discontinued.

Gradually, over time, the cost of housing increases as construction progresses. Experts have found that the construction of each additional floor increases the value of real estate by approximately 3% Therefore, the sooner the funds are invested, the greater profit will be received in the future.

Consider the advantages and disadvantages of investing in real estate under construction.

Among the pluses (+) are the following:

- high level of profitability, as well as liquidity;

- reliability - housing extremely rarely gets cheaper (this applies especially to large cities);

- high level of supply, which means a large selection of real estate for purchase;

- various ways of using real estate in the future (resale or rental).

It turns out that one successful investment transaction can be profitable for many years. for examplehaving bought an apartment in a house under construction from the developer, the investor can rent it out in the future. In the end, he gets passive incomewhich is not limited by any time frame.

This method of investing has minuses (-). The main thing is that the demand for housing is determined by a huge number of factors. for example, during the crisis, many do not buy apartments, having decided to postpone such an event indefinitely. And there is also a huge risk that the construction of a residential building may be frozen (suspended) or completely discontinued due to the financial difficulties of the builder.

But it is worth noting that most specialists, comparing investments in real estate under construction with other ways of investing funds, conclude that they are much less risky than, for example, playing the stock exchange.

Successive stages of investing in construction

Successive stages of investing in construction

5.3. How to invest in construction - 5 main stages

Any investor knows that investments according to a pre-prepared plan can increase the level of profit and minimize the riskiness of investments. Investments should be carried out sequentially, in accordance with the developed strategy. Five stages of this process can be distinguished.

Stage 1. Choosing a developer

A mandatory and important event at the initial stage of investing in construction is developer analysis. It is important not only to find out the name of the developer, but also to clarify what his reputation is. Specialists recommend investing only in those objects under construction, the construction of which is carried out by a well-known construction company in the city.

In the process of choosing a builder, it is important to consider:

- company reputation;

- how many facilities the company has already commissioned;

- Feedback

- how experienced the company is in integrated construction;

- how many investors does the developer have;

- partnership with credit organizations (banks carefully choose with whom to cooperate, conduct a thorough analysis and do not interact with developers who have a dubious reputation);

- how carefully does the developer comply with the law (the main regulatory act is federal law 214-FZ).

In Moscow and the Moscow Region, you can trust the following developers:

GK PIK - One of the largest developers in Russia. The company was founded in 1994, it successfully implements major construction projects throughout Russia. Focused on erection affordable housing. Over the years, it was built about 250 thousand apartments with an area of 15 million square meters. m. It is one of the backbone enterprises in the Russian economy.

A101 Development - the company has built about 500 thousand square meters. m residential real estate, as well as more than 50 thousand - commercial. The developer is also building kindergartens and schoolsinteracting with the budget. Collaboration has been established with several large banks as part of mortgage lending programs. The developer is included in TOP-5 in the Moscow region and TOP-15 throughout Russia.

Capital group - A company that deals with the full cycle of construction activities from the analysis of land for construction to the decoration of finished real estate. Completed 71 projects, resulting in the construction of 7 million square meters. m. area. The company's facilities were named the best projects in Moscow and the Moscow region.

Stage 2. Choosing an investment object

Another important step in investing in real estate under construction is choosing the right object. The best place to start is from the area where housing demand is highest.

When choosing an object for attachments, it is important to consider the following parameters:

- infrastructure;

- the proximity of public transport and metro stations;

- other characteristics that affect the degree of comfort of living.

If you plan to invest in commercial real estate, you should think in advance about the ultimate goal of the investor. It will also be useful to draw up a professional business plan.

Stage 3. Negotiation

When the developer and the investment object are selected. Can we start negotiating. It is important to understand that in accordance with the laws of our country, it is impossible to register the rights to real estate under construction.

However, the investor has the right:

- draw up an equity agreement;

- join a building society;

- register an investment deposit;

- conclude a share contribution agreement.

Experts advise to stop on the contract of participation.

In addition to the method of registering the agreement, the conditions for making funds are discussed. The main ones are the acquisition of by installments (payment by installments) and one-time deposit of funds, but other options are possible.

Stage 4. Study of documentation

All agreements concluded must comply with applicable law. It will be useful to check them with the help of an independent lawyer. Many people think that this is a waste of money. But saving on transactions is not advisable.

Stage 5. Conclusion of the contract

The final stage of the transaction is conclusion of an agreement. Before signing the final version of the agreement. It is important to carefully study all of its points.

In this case, you should pay attention to:

- when it is planned to finish construction;

- what are the conditions of termination;

- the price should be fixed, there should be no conditions on the basis of which it will change;

- fines in case of violation of the terms of the contract should be prescribed for each party;

- force majeure circumstances.

It is important to approach the acquisition of real estate under construction with utmost care and responsibility.It is important to remember that there are risks that can be reduced by clearly observing the sequence of stages of investment.

5.4. How to make money on investments in construction - TOP-3 working methods

The investor should know what methods of earning on the acquisition of real estate under construction are the safest and most proven.

Method 1. Rental

Earnings on the transfer of real estate for rent is long term investments. But this option is characterized by a stable level of profitability.

The payback period in this case exceeds five six years. But do not forget that the areas in any case remain the property of the investor.

In large cities, there is a demand for rental of various types residential real estate: luxury apartments for a day, rooms located in sleeping areas, studios for young families and others.

If you take into account commercial real estate, it can be noted that the demand for it from entrepreneurs is also stably high. Especially popular in large cities are premises located in business and shopping centers. The only drawback of commercial space is the need for investment quite large sums of money.

For purchase apartments usually enough 1,5-2,5 million rubles. If you plan to invest in commercial real estateapproximately 2-3 times large sum.

Method 2. Acquisition of an apartment under construction for sale after commissioning

If you buy real estate under construction for resale, you can pay back the invested funds quickly enough - already through 1-2 of the year. The faster construction is completed, the more interesting it is for investors. Particularly successful investors in one year receive an income of 100% of invested funds.

It is important to evaluate other possible options. You can make a quality repair in the finished apartment. As a result of such actions, its cost will increase by about a quarter.

Method 3. Participation in collective investments

Investors who are looking for the safest options for investing in real estate under construction can be advised cooperate with intermediaries. You can also become a member professional investment projectwithout buying real estate at all. To do this, it is enough to join a collective investment fund and receive income as a shareholder.

In Moscow and the region there are several reliable funds that invest in real estate. Including under construction:

E3 investment - here the minimum amount for entry is 100 thousand rubles. When profit is guaranteed at the level of 25-90 percent. All investments in the fund are insured. The investor can independently choose the payback period of the invested funds. from six months before two years. Investors' funds are invested by professionals in highly liquid real estate, the investor is left to make a profit. This option is passive earnings with guaranteed profit and minimal risk. The company provides information support, as well as free advice to investors.

Sminex - the company invests in finished apartments, as well as objects at the construction stage. The company itself builds houses; as an additional service, investors receive repair of apartments. In addition, the company takes care of finding tenants. The company builds cottages, residential buildings, commercial facilities. The indisputable advantage of the presented organization, experts call the focus on achieving high quality real estate under construction, as well as their safety during operation.

Thus, there are several ways to make money on real estate under construction. They differ not only in the level of profitability, but also in the efforts that will be required from the investor.

5.5.4 main risks when investing in real estate under construction

Any investment carries a risk of loss of invested funds. To minimize the likelihood of losses, you should study in advance what schemes scammers use in real estate, what you should be afraid of when investing in construction.

Risk 1. Soap bubble

The first way to trick gullible investors is extremely simple. One-day companies sell to trusting investors myth, but not really under construction objects. All work on construction sites are conducted exclusively for eye aversion.

Often, such projects are organized and conducted with the help of various legal structures. As a result, transactions from the side look absolutely legal. However, as soon as the scammers collect a sufficient amount of money, they disappear along with the contributions of investors.

The first way to identify a soap bubble is to greatly lower the value of real estate. The investor should compare prices with the average in the area in question. Too low a cost should alert.

It is also important to make sure that information about the developer is available in the official registry. It includes all existing construction companies. Therefore, if the company in question is not on this list, it is not a real legal entity.

Risk 2. Bankruptcy of the developer

There are many reasons why a construction company may go bankrupt:

- ineffective management;

- misuse of funds;

- lack of finance;

- high costs.

Naturally, the lack of money affects not only the construction company itself, but also investors. In order not to encounter such a problem, choosing a developer, you should focus on large company, which has already commissioned a large number of constructed facilities.

Risk 3. Failure to comply with deadlines for real estate

Another problem for investors in real estate under construction is construction failure. This risk is especially unpleasant for those who purchase real estate with the help of credit funds. The lender does not care when the property will be commissioned; it is important for him that all debts be repaid on time and with appropriate interest.

Specialists came to the conclusion that every day of failure to meet deadlines eats up 0,01% of investor income. In percentage terms, this is a little. However, in terms of rubles decent amount, especially when commissioning is delayed for several months or even years.

Risk 4. Force majeure, as well as unpredictable changes in the real estate market

These circumstances may also lead to the loss of part of the funds by the investor. An example of force majeure is the onset of a prolonged economic crisis. As a result, real estate supply can significantly exceed demand. This circumstance leads to a significant reduction in the value of real estate - often 10-20%. Even when the situation clears, investors will already lose some of their potential income.

Also an example of force majeure circumstances can serve natural disasters (forest fires, floods, earthquakes), wars, disasters at industrial enterprises. The only way to protect yourself from such risks is to real estate insurance.

We recommend reading material on home insurance, which describes important points when making insurance for an apartment or house.

Thus, like any type of investment, investments in real estate under construction are accompanied by various risks. Some of them can be minimized by conducting a thorough analysis in the process of selecting an object for acquisition. In other cases, insurance helps to avoid unpleasant consequences.

6. Practical recommendations for increasing profits from real estate investments

By investing money in real estate under construction or finished, any investor seeks to maximize the final profit. You can do this using the methods below.

Recommendation 1. Make re-planning and coordinate (legalize) it

Redevelopment of a residential property - The simplest option that allows you to make housing more functional without changing its total area. If you carry out redevelopment activities correctly, you can increase the cost of an apartment or house 15-30%.

In this case, it is not necessary to carry out an uncoordinated redevelopment. All planned changes must be registered with the authorities dealing with these issues. Today it is an architectural department in BTIas well as the district administration.

It’s important to know that legislation prohibits some types of planning changes, eg, demolish load-bearing walls, as well as expand the kitchen due to living space, increasing its size by more than a quarter.

Recommendation 2. Attach additional areas

This option to increase the cost is available. for private houses and cottages. There you can build additional floors, convert attics into attics, build a balcony or a porch, and make other architectural changes.

Recommendation 3. Make a quality repair.

If you make a quality repair, the price of the apartment will increase approximately 15-25%. The profit will be higher if the repairs are done on their own, investing only in the purchase of materials.

It is important to buy quality materials. Buyers may well distinguish good-quality consumables from cheap Chinese ones.

Recommendation 4. Convert residential real estate to commercial or vice versa

Having studied the demand for real estate in a certain area, you can transfer non-residential real estate into residential and vice versa. Profit from the conversion of residential space into commercial is relevant for large cities, especially for business districts and walkable streets.

Thus, it is important not only to invest in real estate, but also to try to derive maximum profit from it. And how to do this, we described above.

Ways to invest in real estate with a small capital

Ways to invest in real estate with a small capital

7. How to invest in real estate with a small capital - 3 real methods

Many people believe that not enough money is an obstacle to real estate investment, but this is not so. Competent business people are able to do with minimal means, as well as attract additional amounts. There are several methods to do this.

Method 1. Borrowing

The most popular way to increase investment capital is loan processing to purchase real estate. Today, many banks provide such loans.

By the way, about where to get money if all banks and microloans refuse, we told in one of the previous articles of our magazine.

The investor should take into account the fact that any borrowing involves payment percent. Therefore, in the analysis process, it is important to consider the additional costs. The planned income should cover the interest on the loan and provide profit.

For a loan should apply to large credit organizations with positive reputation.

It is not necessary to take a loan at interest. Many wealthy relatives give loans to close people at no extra charge.

Method 2. Attracting Co-Investors

Ideal option for investors who have insufficient capital, - come together. For those who carefully thought out the project and convince others of its effectiveness, there will be no problem finding partners.

Method 3. Choosing the right strategy

Any investor understands that competent investment planning is an important component of their success. Those with insufficient investment knowledge may be advised to seek the help of more experienced investors.

An example of high-quality support for beginners are various investment clubs. Such projects bring together investors who pass on their experience to beginners. Clubs conduct various classes - courses and seminars, detailing private investments. Considerable attention is also given to real estate investments.

On the subject of real estate investing, the following questions are being studied:

- strategies;

- how to enter the world of investing with minimal capital;

- investments in various types of real estate;

- rent and sublease.

Thus, lack of capital is not an obstacle to investing. Any single-minded person will find ways to implement profitable investment.

8. The help of professionals when investing in real estate

Help from professionals there is no free. However she helps much increase the level of investment profitability.

Those investors who want to minimize the risksbut at the same time ensure a sufficiently high profit, you can be advised to collaborate with experts in the field of real estate investing.

In Russia, three companies working in this direction can be particularly distinguished:

E3 investment offers to invest for a long time in different types of real estate. This ensures a high level of income. Here is the minimum threshold for entry into the real estate market. Investors can deposit an amount of 100 thousand rubles or more.

Those who wish to invest in this company can immediately find out the level of expected profit. To do this, just use the calculator on her website.

Contributions to an investment company are highly reliable. All types of assets have three types of insurance.

Activo Offers access to the most liquid areas. Investment security is ensured through independent collective ownership. When investing from two million rubles, the company guarantees profit in the amount of 11,6%.

An investor acquires real estate and transfers it to professionals. Each month the company gives its customers full reporting, and also guarantees the safety of invested funds.

Gordon rock is a real estate agency represented on the international market. Investors, using the services of the company, can invest in hotels, commercial, as well as residential real estate located abroad.

The following services are also provided:

- purchase of rooms in hotels, catering facilities, medical centers, mini-hotels;

- acquisition of real estate for persons of retirement age;

- investment in a ready-made business in several countries of the world;

- consultations and seminars on effective investment.

Thus, in order to invest in real estate, it is not necessary to possess large capital and significant knowledge. It is enough to turn to professionals for help.

9. Frequently Asked Questions (FAQ)

The subject of real estate investing is multifaceted and difficult to understand. Therefore, many investors have various questions on this topic. Especially it concerns newcomers. We will try to answer the most popular questions.

Question 1. Where is it more profitable to invest money: in real estate or in a bank for a deposit?

Often people without experience in investing, having an impressive amount of money, are wondering what to do with it - to buy an apartment and rent it out or put it in a bank for a deposit?

Assume that an investor is available 3 000 000 rubles. Consider both investment options.

- If you put money in a bank at 10% per annum, in 12 months you can earn 300 thousand rubles, if the terms of the deposit do not provide for capitalization. About what is the capitalization of interest on the deposit account and how to calculate the contribution yourself with replenishment and capitalization, read in a separate article in our journal.

- Now suppose that the investor bought a one-room apartment in Moscow for the funds he has. By renting it, he will receive 25 thousand rubles a month. As a result, for the year the same amount will come in 300 thousand rubles.

Comparing the two options, do not lose sight of the fact that in the case of a lease there are additional costs - for utility bills, taxes, repairs and others. In addition, you will have to spend a significant amount of time searching for a suitable property, settling tenants.

It would seem that deposits are much more profitable than buying an apartment with subsequent rental. But this is not entirely true, analyzing the example, we did not take into account the presence of inflation. Depreciation of funds gradually eats up savings.

It is worth considering the important investment rule. - you can not trust the official data on the level of inflation. In fact, money depreciates much faster. It turns out that in the best case, the interest on the deposit will block inflation, but it is unlikely to make money on such investments.

At the same time, property prices rarely fall. In the long run, its value is growing. Also, rental prices are constantly rising.

Thus, it turns out that when considering the short-term period on deposits you can earn more. However, given the fact that apartments are becoming more expensive, it can be noted that real estate helps to more effectively resist inflation.

Question 2. What real estate is more profitable to rent: residential or commercial?

Some investors purposefully analyze the real estate market in order to understand which objects to rent out more profitably - residential or commercial. In general, it is impossible to unequivocally answer this question, since there are commercial and financial risks in the market.

For large investors, usually preferred commercial real estate. Experts believe that such investments pay off much faster. However, due to their characteristics, they are more difficult for beginners.

Concerning residential real estate, it is beneficial to rent it out to those who received it without cash costs, for example, by inheritance or as a gift. When buying such a property, it will pay off for a very long time.

Worth understandingthat investing in commercial real estate is rather risky. This is due to the fact that they are more affected by the situation in the country's economy, for example, the onset of the crisis period.

Investments in commercial real estate are subject to other types of risk that are difficult to account for. As a result, errors may be made in the process of calculating the required capital, which ultimately will lead to an increase in the likelihood of buying an object with low liquidity. Such investments may not only not make a profitbut also entail significant losses.

However, speaking of financial relations, it can be noted that in the case of commercial real estate, they are much more stable than the owners of residential premises with their tenants. Making a lease for commercial real estate, the tenant is interested in maintaining it in good condition. This is due to the fact that it is the condition of the areas where the activity is carried out forms an opinion of the customers about the company. Tenants rarely try to maintain it in the best possible condition.

A separate issue is the income received from the rental of various types of real estate. Everyone knows that when comparing premises of a similar size, commercial facilities bring much more income than residential.

Note! When buying a property, the investor must analyze what potential income will it bring. This is especially true of those objects that are already leased. The forecast of the profitability of the property at the time of its acquisition is quite possible.

Should also compare effortsrequired to manage multiple properties. Naturally, that objects residential real estate (even if there are several of them and they are located at different ends of the city) it is much easier to manage than, for example trade areadivided into parts and leased to several businessmen. It is even more important that commercial real estate is leased for a much longer period than residential property.

Some investors will object that today real estate management can be transferred to specialized organizations. But this again requires additional cash investments.

What conclusion can be drawn from here?

Thus, renting commercial real estate is more profitable. However, this requires an investor to make a significant investment of money and effort, as well as high-quality knowledge regarding the market conditions.

Investments in residential real estate are available to a wider group of investors. Money capital for this will require much less. At the same time, such real estate can become a source of almost passive stable income for a very long period of time.

But still, investors who have at least minimal experience in investing in real estate can be given important advice. Before making a choice in favor of any real estate object, it is worthwhile to conduct a thorough analysis of all possible options, paying attention to both residential and commercial real estate.

Question 3. How to buy real estate as cheaply as possible?

It is unlikely that anyone will doubt that real estate is a profitable option for investing funds. Nevertheless, there are ways to significantly increase the bottom line. To do this, you can use the tips on how to buy property as cheaply as possible. With a good combination of circumstances, you can save about 30% of the cost.

Consider the possible options:

1) We discussed in detail acquisition of real estate under construction. Such investments are profitable and have good profitability. However, the level of risk in this case is much higher.

Unfortunately, it is possible that the construction of the house by the developer will not be completed on the appointed day. Moreover, there are cases when houses have not been commissioned for many years. In such situations, it is often unclear whether the construction work will be completed at all.

In most large cities there are several associations of deceived equity holders. These people for various reasons - for personal needs or for the purpose of investing - bought apartments in houses under construction, but in the end stayed with nothing. Suing a construction company can be difficult, especially if it declares itself bankrupt.

2) Another option to reduce the amount of investment - acquisition of real estate without repair. The investor invests in finishing work, after which the price of real estate immediately rises. With a good combination of circumstances, conducting high-quality repairs using high-quality materials, you can quickly get about 15% arrived.

3) Investors with experience in the real estate market use even more interesting ways to save money on acquiring an investment. For example, many of them acquire property put up for auction for various reasons.

If individuals and companies are declared bankrupt, their creditors are interested in returning the money owed to them as soon as possible. Therefore, often bankrupt property is put up for auction at a very greatly reduced prices. About bidding and bankruptcy auctions, we wrote a separate article.

4) In connection with the occurrence of a large number of defaults on mortgages and other types of secured loans, credit organizations often borrow property from their customers, which, under the agreement, was a guarantee of repayment of funds. Such real estate is also sold at low prices, since banks are important in the speed of return of their own funds.

Where to look for such offers:

On the Internet you can find specialized sites on which information is collected on the sale of real estate objects confiscated from debtors, as well as seized as collateral. Often, investors here find very interesting options for investing.

In addition, information on the sale of collateral as well as confiscated real estate of legal entities is contained in the respective bankruptcy register.

Question 4. What books on real estate investments should a beginner read?

Any questions related to the field of finance require people who deal with them with certain knowledge. Therefore, it is important to study specialized literature on topics of interest. Real estate investment is no exception.

Book 1. Robert Kiyosaki "Real Estate Investments"

Many professional investors believe that the best book on real estate investments was created by Robert Kiyosaki. It is called quite trivially - "Investments and Real Estate".

The content of the work is unique. Famous in financial circles, Kiyosaki has gathered 22 professionals working in the field of real estate investment. The result is a book that contains not only the theoretical foundations of investing in real estate.

Also in this work is a huge number of tips that do not lose their relevance, and other stories that professionals share with the reader.

Book 2. Eric Tyson "Real Estate Investments for Dummies"

This is the perfect book. for newbies in real estate investment. In an accessible form, it describes how to invest money profitably and correctly.

This is the perfect book. for newbies in real estate investment. In an accessible form, it describes how to invest money profitably and correctly.

The work contains detailed qualitatively structured instructions on what actions a beginner needs to perform.

Anyone who wants it, even without a financial education, will be able to extract a lot of useful information from the book, easily reading it.

Book 3. McElroy K. "The ABC of Real Estate Investing"