How to fix a credit history: instructions for correcting a credit history + 6 ways to improve (restore) CI

Hello dear readers of Rich Pro! Today we will focus on the correction of credit history, namely, how to correct your credit history and whether it is possible to improve (restore) CI if it is damaged.

After reading this article from beginning to end, you will also learn:

- what are the causes of bad credit history;

- how much credit history is stored in BKI;

- how to clean credit history and whether it is possible to clear it in Russia;

- which MFIs are best addressed to improve CI.

At the end of the article, we traditionally answer the most popular questions on this topic.

The presented publication will be useful not only to those for whom the credit history is already damaged, but also to those who simply regularly issue loans.So let's go!

About how you can fix and improve (restore) your credit history, is it possible to completely clear it, what methods exist to correct your credit history - read in our issue

About how you can fix and improve (restore) your credit history, is it possible to completely clear it, what methods exist to correct your credit history - read in our issue

1. What is the credit history of the borrower?

In the process of deciding on the possibility of issuing a loan to a client, the bank first of all evaluates its solvency. The key indicator in this case is credit history.

Spoiled reputation, unfair fulfillment of financial obligations in the process of servicing previous loans can become a serious obstacle to obtaining loans in the future.

It's important to know! Each appeal to a financial organization must be recorded in the credit dossier. Even with a refusal to issue a loan, information on the application process is reflected in the credit history.

To increase the chance of obtaining funds for consumer purposes, car loans and mortgages positive credit history. Even with a competent business idea and a quality project, credit organizations will refuse to finance if in the past the borrower had problems with fulfilling loan obligations.

Relations between the borrower and banks in Russia are regulated Federal Law "On Credit Histories". It is this act that determines the basis for working with data on the reputation of the borrower. Thanks to the adoption of the said law creditors' risk has significantly decreased, and government protection of clients has improved.

Some customers who are reliably aware that their credit history is damaged are interested in when it is “reset to zero”. In fact, the answer to this question is likely to upset unscrupulous borrowers.

The credit bureau stores information on the fulfillment of obligations for 15 years from the date when the data was last changed.

Only when from the moment of violation passes 15 years, information about them will be canceled. Therefore, if delays were recent, the likelihood of a positive decision on loan applications is minimal.

Information about the reputation of the borrower is stored in credit bureau (abbreviated BKI) It is a commercial organization, the purpose of which was to provide information services for the formation, storage and processing of data, as well as providing reporting on request.

To find out in which particular bureau information about a particular borrower is stored, you need to know the code of the subject of the credit history. We talked about it in detail in one of our articles.

The main reasons for poor credit history

The main reasons for poor credit history

2. Why a credit history can become bad - 5 main reasons

In fact, maintaining a perfect credit history is not so difficult. It is enough to conscientiously fulfill the loan obligations undertaken, not to allow intentional distortion of information about yourself. If you follow these simple rules, you will not be able to ruin your reputation.

Meanwhile, we can distinguish 5 main reasons, which most often spoil the credit history of borrowers.

Reason 1. Late or incomplete payments

In the process of issuing a loan, the borrower signs with the bank loan agreementof which an integral part is payment schedule.

It is important to strictly adhere to this document, to make payment in accordance with the period and amount that are indicated in it. Do not forget that even a few days of delay and underpayment of just a few rubles will negatively affect your credit history.

Reason 2. Untimely receipt of funds in the bank

Many banks offer several different payment methods. Using each of them, you should consider terms of admission. It is important to remember that the moment of payment is considered to be the moment the funds are credited to the credit account, and not their sending.

If the money is paid on the date indicated in the schedule, and the crediting period is several days, this fact will also be considered a violation and will adversely affect the reputation.

Reason 3. The human factor

Sometimes a credit history can be damaged due to errors of a bank employee or the client himself. It is enough to make a mistake in the borrower's name, amount of payment or due date to spoil the reputation. That is why you should carefully check the signed documents.

Moreover, experts recommend checking your credit history annually (especially since 1 once a year you can do it for free). We wrote about how to find out your credit history for free by last name via the Internet in a previous article.

Reason 4. Fraud

In the credit sector, fraud is quite common. His influence on credit history should also not be discounted.

For example: There are cases when fraudsters illegally received a loan using a passport of a citizen. Naturally, they did not make payments on it. As a result, the credit history of the passport holder with such a fact was spoiled.

Reason 5. Technical Failure

The possibility of technical errors cannot be ruled out. When paying, it may occur failure in terminal and software. As a result, the payment will not be received or will be received at the wrong time.

Even if an investigation is conducted and it is proved that the client is not to blame for the violation of the payment deadlines, information about him may already be sent to the BCI. In order to prevent the influence of such facts on the credit history, it is important to periodically check it.

Despite the fact that the information in the credit history is stored for a long time, do not think that all violations have the same effect. Naturally, the delay in 1 day over 10-year-old loan can not be compared with a complete rejection of payments in a few months.

Not everyone is included in the list of credit history bureaus due to violation of loan payment terms. Sometimes the “fines” never even took out loans or paid them on time.

The fact is that malicious non-payment of utilities, as well as taxes, can also adversely affect credit history. It turns out that the reputation is affected by the fulfillment of absolutely all financial obligations, and not just credit.

3. Is it possible to clear (clear) the credit history ✂?

It is not possible to delete any information from the credit history, and even more so to completely clear the information about the borrower. All data stored in the catalogs of BKI are under serious multi-stage protection.

Access to information is available only to a small number of responsible employees. Moreover, each action they commit is recorded in the system. According to Russian law, information about the borrower in the BCI is stored for 15 years since their last change.

It should be understood that any changes are made only at the request of the client and with written consent. Financial institutions do not have the right to independently request information from the credit history, as well as submit requests for its change in the absence of the borrower's relevant consent.

Based on the foregoing, it can be concluded that any organizations that claim to be able to remove negative information from their credit history are actually ordinary scammers.

Some companies, with the official consent of the client, request information from the bureau about their credit history. Upon receiving the report, they carefully study it in search of loopholes to improve the borrower's rating. Naturally, this process is lengthy. Moreover, such companies do not work for free. Therefore, the client will have to pay a considerable amount for cleaning credit history and other similar services.

4. How to fix errors in the credit history ✍ - measures to correct inaccuracies

Step-by-step instructions for fixing credit history errors

Step-by-step instructions for fixing credit history errors

Credit history can be damaged not only in case of poor performance of their financial obligations. Information may contain inaccuracies that distort it.

Most often, errors can be attributed to one of the following types:

- Invalid information about the borrower. Most often, errors occur in the date and place of birth, address of residencein writing complex last names, the name and patronymic. Such inaccuracies do not cause any particular problems. When they are detected, they are quickly eliminated without any problems.

- Information on bad loans. Sometimes employees of financial institutions for some reason do not inform the BCI that the borrower has fully paid off the loan. Most often, such situations arise when the bank is deprived of a license and a temporary administration is established. In this situation, problems with credit history arise not through the fault of the borrower.

- Reflection in the credit history of information about loans that the client has never received. This type of inaccuracy is one of the most unpleasant. When studying a report on their credit history, borrowers can find in it delinquencies for loans they never issue. This is most often explained 2- for the reasons - carelessness of bank employees and fraud facts.

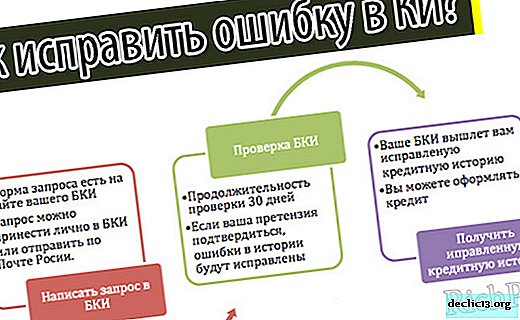

If errors are identified in the credit history report, you should immediately send it to the BCI notification about it. It is important to attach copies of documents and certificates to it that confirm the fact of errors in the data. Such copies must be notarized before sending.

It is legally established that BKI employees are entitled to consider the notification received within 1 month. In cases where it is necessary, a bank that has sent controversial information to the bureau may be involved in the audit.

When the investigation is completed, a formal response will be sent to the borrower. If the client does not satisfy the received conclusion, he has the right to appeal to the court to resolve his issue.

When deciding to correct a credit history, important to remember, that you can only change the information that appeared in the file of the borrower erroneously. It makes no sense to try to erase negative data that is true. The time for this lesson will be wasted.

Proven ways to improve your credit history if you do not give loans

Proven ways to improve your credit history if you do not give loans

5. How to improve credit history, if it is damaged - TOP-6 ways to improve bad CI

If, when applying for a loan, the client constantly receives refusals, perhaps financial organizations have doubts about his solvency. Most often they are associated with problems in credit history.

However, you should not think that if your reputation is spoiled, you will never be able to get a profitable loan again. In fact, there are several working methods that can help fix your credit history.

Method 1. Use a special program to improve credit history.

Today, borrowers with bad credit history are many. In the struggle for each client, financial organizations develop specialized programs to improve reputation. After passing it, the client can count on a favorable offer to obtain a loan.

For instance: Program "Credit Doctor" from Sovcombank. The essence of the method is the sequential execution of several loans with a gradual increase in amounts. At the end of the program, upon successful completion of the program, the borrower can count on obtaining the optimal loan at the average market interest rate.

Method 2. Get a credit card

One of the easiest and least costly ways to fix your credit history is issuing a credit card. In this case, you should choose the banks that are the least demanding of potential customers. We wrote in one of our articles about where credit cards are issued with a passport with an instant decision online.

Credit card correction scheme

Credit card correction scheme

The easiest way to get a credit card is in a financial institution that serves a salary card, is actively involved in attracting customers or is actively promoting a new loan product.

But keep in mind that to fix the reputation you have to regularly spend money from the credit card limit, timely replenishing it. After some time, you can expect to increase the credit limit.

When choosing from several programs for issuing credit cards, you should pay attention to the following parameters:

- Grace period, its presence and duration. In case of cashless spending of money and returning it within a grace period, interest will not be calculated. In some cases, a grace period is also provided for cash withdrawals;

- Issue costas well as annual maintenance;

- Rate - the lower the interest rate, the less will be the overpayment on a issued credit card;

- Various discounts. Are there any bonuses, cashback on the card?

When replenishing the card, it is important to carefully consider the rules for calculating the deadline for depositing funds. Since they may differ in different banks, customers often deposit money after the end of the grace period and do not understand why they were charged interest.

If banks refuse to issue a card immediately for a large amount, you should agree to a small credit limit. If you constantly maintain activity - regularly pay with a card and replenish it in a timely manner, you can eventually expect a limit increase.

Method 3. Get a loan from a microfinance organization

Another reasonably effective way to fix your credit history is to obtaining loans in microfinance organizations. Such financial companies lend small amounts of money for a short period of time.

You can get a microloan directly on the Internet by crediting to a bank card. If you issue it several times and return it in a timely manner, you can count on a correction of your credit history.

Serious disadvantage microloans is high overpayment. The rate is usually indicated daily, so many customers think that the percentage is quite small. In fact, if you recalculate the annual rate, you get an overpayment of several hundred percent.

It is important to evaluate your financial capabilities even before receiving a microloan. Often in a month you have to return to 2 times the amount that was received.

When there is no certainty that it will be possible to repay the debt with interest on time, it is better not to issue a microloan. If you have problems with repayments, your credit reputation can be further damaged.

When using microloans, it is best to borrow small amounts for a period of several days. Successive repayment of several of these loans leads to replenishment of the credit history with positive information. As a result, you can count on more advantageous offers on traditional loans. For information on how and where to get a loan with bad credit history without income certificates, read the article here.

However, using the described method, keep in mind that early repayment by microfinance organizations is considered as a disadvantage. It should also be borne in mind that information is sent to the BKI monthly or 1 once per 2 weeks.

Method 4. Purchase installments

One of the most affordable ways to improve your credit history is to pay by installments. This option is best suited for those who plan to purchase a fairly expensive product.

It does not matter which product to buy. Making out commodity credit or by installments, it is important to pay them in a timely manner. This will help to significantly increase the likelihood of a positive decision on applications submitted to the bank in the future.

Good alternative 2th named schemes can become installment card. Similar offers are actively promoted recently by many banks. In order for such a product to help correct your credit history, it is important to carefully analyze your financial capabilities and not violate the terms of payment.

Method 5. Turn to the court

As we already said, the borrower is not always to blame for problems with credit reputation. In some cases, the information posted in the report may be erroneous.

If inaccuracies are found, first contact to the creditorthrough whose fault they were admitted. If corrections are refused, you will have to interact with credit bureau and with court.

Changing information in the credit history on the basis of a court decision in most cases is carried out when errors occur for the following reasons:

- software and technical failures during the processing of the borrower's payment;

- fraudulent activities;

- errors of employees of the credit organization responsible for the transfer of data to the BKI.

Prior to the trial, mandatory pre-trial settlement procedure with the involvement of a credit bureau.

Method 6. Make a deposit in the bank

To inspire confidence in the creditor, you can draw up a bank deposit. Of course, this option requires a certain amount of money. Ideally, the contribution should be regularly replenished.

Often their customers who have a deposit, banks offer a loan on fairly favorable terms.

Even if there are no serious savings, you can find a contribution with the possibility of replenishment and partial withdrawal throughout the term. Having drawn up such an agreement, it remains to deposit part of the salary into the account. If necessary, funds can be easily removed.

All the methods described above allow you to change your credit history for the better. However, do not count on an instant result. Improving your credit history is always a long and painstaking job.

Correction of a credit history using microloans in 3 stages

Correction of a credit history using microloans in 3 stages

6. How to restore a credit history using a loan - step-by-step instructions

When deciding to correct a credit history, first of all, it is necessary to choose a partner company that will help to do this. To avoid problems when choosing in favor of microloans, we recommend using the instructions below.

Stage 1. The choice of microfinance organization (MFI)

Before proceeding with a microloan, you should familiarize yourself with the information about the companies for its issuance. At the same time, it is necessary to study the reputation of MFIs, as well as find out with which BCR it works.

To assess the rating of a microfinance organization, you need to pay attention to the following indicators:

- term of work in the Russian financial market;

- the presence of branches in various cities across the country;

- study customer reviews.

Experts do not recommend to issue a loan in the first company that comes across, even if it seems that the conditions in it are ideal.

It is best to analyze the conditions of at least 3 MFIs and draw a conclusion based on the following criteria:

- Cooperation with BKI. It is best to apply for a loan to a microfinance organization that transmits information to the BKI, which contains information about you. Another option is to work with MFIs, which send information to several bureaus.

- Convenience of obtaining a loan. It is important to evaluate what methods the service uses. Most often, money is issued in cash or online to a bank card. In the first case, you should ask in advance where the MFI office is located.

- Loan interest rate. Some microfinance organizations indicate the rate in a veiled way - in the form of an overpayment or only in an agreement that few borrowers read before applying. At the same time, most MFIs have a calculator on the site that allows you to calculate the overpayment. With its help, you can easily analyze how much a loan will cost.

- Legal registration of a loan. Experts recommend that even before filing an application, request from the MFI a sample contract and carefully study it. At the same time, it is worth paying attention to the presence of so-called stop factors. So, in cases where the contract indicates the need to pledge valuable property, professionals are not advised to agree to the design of such a loan.

- Availability and size of additional commissions. It is important to know whether the lender charges a fee for applying for a loan, issuing cash, accepting payments.

Stage 2. Sending a loan application

When a microfinance institution is selected, it remains to file application. To this end, you can visit the office of the company. It’s important to bring along passport, as well as second documentidentity card.

However, it is much more convenient to apply online. Today, most MFIs have this opportunity. Documents usually required about 30 minutes.

Specialists do not get tired of reminding borrowers that before signing the contract, you must carefully read it from start to finish.

It is important to check that there are no indications that in case of non-payment of the debt the borrower will have to transfer his property to the creditor. You should also make sure that the loan servicing rate is consistent with the proposal.

Of great importance when applying for a loan are fines. Therefore, information about them must be carefully studied, paying attention to the conditions of accrual and the size of the sanctions.

When the terms of the contract are verified, it remains to sign the agreement and receive repayment schedule. It is important to clarify in advance what methods of depositing funds can be used and choose the best options.

Payments can be made in 2 ways:

- parts at regular intervals;

- at the end of the term.

Stage 3. Receiving and returning money

Specialists recommend using non-cash methods to receive funds - to a bank card, electronic wallet, money transfer. When using such options, the borrower retains documentary evidence of the amount received.

When funds are received, it is important to dispose of them wisely. In this case, the terms of return established by the contract should be taken into account. If no financial receipts are planned for the indicated date, you should save the amount received so that you can make a payment.

Important to remember, that violation of the terms of the return can further aggravate the situation with a damaged credit history. Therefore, payment deadlines must be observed. In the process of payment, it is worth taking care of the preservation of documents confirming the deposit of funds.

7. TOP 3 MFIs to correct credit history

It will take a lot of time to independently study and compare the loan conditions of several MFIs. To facilitate this task, we consider TOP 3 companieswho have a quality reputation and are distinguished by favorable conditions.

1) Ezaem

Company Ezaem offers to issue the first loan absolutely free. With re-lending, interest accrual begins.

In terms of the annual rate for the use of funds during 15 days have to pay more 700%. If you get a loan on 30 days, the rate will be set at about 600% per annum

Borrowers can independently choose how to receive funds for approved applications.

Money can be received in various ways:

- in cash;

- to a bank account or card;

- Qiwi wallet;

- money transfer via Contact system.

Payments can be made in cash, by credit card, or by post or bank transfer. In order to preliminary study the terms of the agreement, the agreement can be downloaded on the MFI website. It also provides detailed lending rates.

2) MoneyMan

For the first loan Moneyman gives a discount - 50% Upon receipt of a loan in the amount of 10 000 rubles the rate is set at 1.85% per day.

You can get money to a bank card or account, in cash, through money transfer systems. Payments are made through payment terminals, by transfer from a bank card or account.

Do not be afraid that the MFI under consideration provides an expanded package of documents. In addition to the contract, you have to sign consent and obligations.

3) E-cabbage

E-cabbage also offers new customers various promotions. Today there is a condition that there is no accrual of interest on the first loan.

E-cabbage on loans sets the following rates:

- during the first 12 days - 2,1% for every day;

- 1,7% for each subsequent day.

Keep in mind that there is no calculator on the MFI website for calculating loan parameters. Therefore, more detailed information about the amount of overpayment can only be obtained in your personal account after registration.

You can receive money, as well as pay a loan, using bank cards, electronic wallets or in cash. MFI claims that information about absolutely all loans is transmitted to BKI.

For clarity, all lending parameters in the reviewed MFIs are summarized in a table.

Table: “TOP-3 microfinance organizations and lending conditions in them”

| MFI | Special loan conditions | Rate | Method of obtaining funds | Repayment methods |

| Ezaem | First loan without interest | For a period of 15 days - more700% APR On 30 days - 600% | To a bank account or card, Qiwi wallet, money transfer via Contact system | By cash, credit card, or postal or bank transfer |

| Moneyman | A discount 50% new customers | 1,85% in a day | To a bank card or account, in cash, through money transfer systems | Through payment terminals, by transfer from a credit card or account |

| E-cabbage | The first loan is granted without interest | During the first 12 days - 2,1% for every day 1,7% for each subsequent day | To a bank card, e-wallet or cash | Via bank card, e-wallet or cash |

The table shows the proposals * of audited financial institutions that provide credit history correction with microloans online.

* For current information on the conditions for obtaining loans, see the official websites of MFIs.

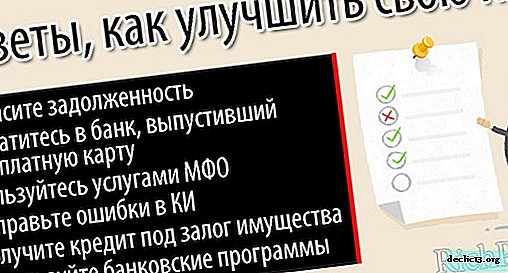

8. How to fix your credit history if you do not give loans - 6 useful tips

In fact, not so long ago, many banks issued loans to absolutely everyone, without checking solvency, only with a passport.

However, as of the beginning2017 overdue debt of Russians to banking organizations exceeded2 trillion rubles.

Moreover, statistics show that more 50% borrowers draw up new loans to pay off existing ones.

As a result, many borrowers found themselves in a situation where they everywhere refuse to apply. Lenders no longer believe that they are able to fulfill their obligations.

But you can fix the situation. To do this, you must clearly follow the tips below.

Real tips on how to restore your credit history if banks do not give loans

Real tips on how to restore your credit history if banks do not give loans

Tip 1. Pay off debt

Experts are sure that the most worthy and at the same time reliable way to restore creditworthiness is to pay off existing debt, for this purpose you will have to take several steps:

Step 1. Send a request to the central directory of credit histories to find out in which BKI there is data about you.

The fact is that credit history information can be stored in several bureaus.

More than 93% of credit histories are concentrated in 4 largest bureaus: NBKI, Equifax, Russian Standard Credit Bureau, United Credit Bureau (OKB)

More than 93% of credit histories are concentrated in 4 largest bureaus: NBKI, Equifax, Russian Standard Credit Bureau, United Credit Bureau (OKB)

It all depends on in which organizations loans were issued. Information at CCCH can be obtained free of charge (unless the intermediary organization draws up a request on behalf of the borrower).

Step 2 When the certificate from the CCCH is ready, you must contact the credit bureau, the client of which is the borrower. There, information is requested about the available information.

Each office provides free help. 1 once a year. But at the same time, you need to contact a notary public so that he assures the signature on the request. Naturally, you will have to pay for such services.

The certificate of credit history reflects information on the facts of the delay in loans. Moreover, for each period, its duration in days is indicated.

When applying for a loan, banks evaluate the delay:

- If it exceeds 30 days the causes that caused the violations are studied, and whether they are eliminated at the moment.

- If the delay is longer than 90 days most likely, they will refuse to issue a new loan.

It is important to understand that information on all types of loans — consumer, car loans, mortgages, and cards — is accumulated in the BCI.

Step 3 When a borrower receives a credit report, he already knows exactly where and how much he owes. It remains to contact the lender and repay the loan.

If the debt is sold to a collection company, experts recommend first of all to demand from it assignment agreementby which the acquisition is made. Moreover, with such an agreement it is worth going to the bank to make sure of its relevance.

Step 4 When the debt is paid off, a request should be made to the credit bureau for entering the relevant information into the report.

After making the full amount of the debt, it is important not to forget to borrow from the employees of a credit institution or a debt collection company.help that the client is no longer a debtor.

Besides, after making the payment, you should save a document confirming the payment of money. If this is not done, there is a risk that the funds will not reach the place and the debt will not be repaid.

Tip 2. Contact the bank that issued the salary card

This option can also help correct your credit history and increase the likelihood of approval for a loan application. This requires employment with an employer who issues funds in a non-cash manner.

Across 3 months of regular charges on the card, you can try to apply for credit card. If the bank agrees and draws up such a card, it is necessary to regularly use the provided limit and repay the debt in a timely manner.

This approach allows approximately 12-36 months to improve credit history. However, this is unlikely to be enough to get a loan for a large amount. Nevertheless, small loans can already be counted on.

Important to remember, that in most cases, when checking the borrower, bank employees pay attention to the latest information in the credit bureau.

Therefore, an undoubted advantage will be the issuance of loans in the recent past, as well as their timely repayment. So, gradually a positive story will block the negative.

Tip 3. Use the services of MFIs, repaying loans on time

This option to improve credit history is quite lengthy. But it allows you to significantly increase the level of confidence of banks in the borrower.

the main thing advantage of this method is that for a loan is usually required only passport. At the same time, MFIs, like other lenders, transmit information on timely fulfillment of obligations to credit bureau.

To improve your reputation with loans from MFIs, you must first take the minimum amount, and after successful repayment, you can increase the size of the loan being issued. After that, it remains to gradually increase the amount and timely fulfill obligations.

Eventually after about 6-12 months you can already try to contact the bank with an application for a small loan. Read also an article on the topic - "Which banks do not check credit history."

Tip 4. Correct credit history errors.

When checking a report on their credit history, borrowers often identify certain errors and inaccuracies in it. Laws allow customers to correct information that is not true.

The procedure will include the following:

- The borrower must send a request to the credit bureau. It is important to reflect information about all errors and inaccuracies that should be changed.

- The creditor, who sent the disputed information, is sent an application to verify the information. During 2weeks, he is obliged to either correct the credit history, or leave it unchanged if the data provided is reliable.

- The credit bureau, in turn, prepares and sends a report to the borrower during 30 days from the receipt of the request.

Important to understand that you should not count on correcting reliable information. Changes are made only in case of real errors.

If the correction of inaccuracies is refused, the borrower has the right to go to the judicial authorities for this purpose.

Tip 5. Get a loan secured by property and high interest

If the credit history is hopelessly damaged, you can increase the probability of a positive decision on the loan application to offer the lender valuable property as security.

It is important that the property meets the following requirements:

- owned by the borrower by right of ownership;

- It was highly liquid, that is, it should be in demand in the market.

If the borrower refuses to make payments, the bank quickly and without any problems realizes the subject of the pledge and will repay the amount owed. Most often used for this purpose cars and the property.

However, in case of serious problems with the credit history, one does not have to rely on favorable terms for granting a loan, even if the provision is of high quality.

Most likely, the money will be issued at a high rate, which can reach 50% per annum But such a loan with a timely return is able to provide positive influence on credit history.

If you want to learn more about how and where it is better to take a loan secured by real estate, read our article.

Tip 6. Use special banking programs.

To correct your credit history, you can use special banking programs. When using them, the borrower gives the money to pay for services to improve reputation.

Despite the fact that funds for such banking programs are not issued to the client, they need to be returned. The size of the loan and, accordingly, payments depends not only on the credit institution, but also on the quality of the credit history of a particular borrower.

In the end another very important tip - never give money, documents or personal information to scammers. It is not difficult to distinguish them: such people guarantee the issuance of a loan and ask for a commission for filling out an application.

Some scammers offer money to improve credit history. Such proposals are extremely doubtful, because only the borrower himself can improve his reputation.

9. FAQ - Frequently Asked Questions

The topic of improving credit history is of concern to many. Moreover, in the process of studying it, a lot of questions usually arise. At the end of the article, we traditionally tried to answer the most popular of them.

Question 1. How can I fix my credit history for free by last name via the Internet?

Many borrowers with a bad reputation are wondering how to improve their credit history via the Internet without paying a fee, providing only a surname.

However, it should be understood that online you can only Find out what information is contained in the report.

Many companies over the Internet offer to expedite the receipt of information. However, they are not able to correct the credit history using only the name of the borrower. The best way they can help is to advise on improving your reputation.

In other words, rehabilitate credit history only by last name via the Internet will fail. Even in cases where it is necessary to correct errors, you will have to prepare a package of supporting documents.

Question 2. When will a bad credit history be reset? How long is it stored in the credit bureau?

Making any loan, it is important to remember the credit history. Any violation of the performance of obligations will affect the reputation of the client for a long time.

How long is the credit history updated? Full zeroing of credit history will occur only in 15 years after the last change to it. At the same time, requests should not be sent to the BCI and new loans should be issued.

However, violations will be nullified in the dossier after approximately 5 years. But here there is an important condition - you should regularly issue loans for a small amount, timely fulfilling their obligations.

Question 3. How to clear the credit history in a common base?

Often on the Internet there is an advertisement with a proposal to delete a credit history or correct information in a report. Surprisingly, many borrowers whose credit history is spoiled still blindly believe that this is possible.

Important to remember, that Russian legislation strictly regulates the possibility of adjusting credit history. You can change it only in case of detection of errors and inaccuracies.

In Russia, there is no way to clear credit history at will alone. The report is updated constantly, therefore no person or company is able to influence the information reflected in it.

The activities of the BKI are strictly regulated Central Bank of Russia. Any information is entered into the credit history only after a certain audit has been carried out. Of course, errors may occur. However, their probability is quite low. By the way, even after the death of the borrower, information about him is still stored 3 of the year.

It turns out that to influence the data in the credit history, and even more so to delete them, simply impossible. The report is an extract with information about loans, amount of debt, as well as allowable delinquencies.

10. Conclusion + video on the topic

Credit history today is one of the most important solvency indicators of a potential borrower. Most lenders pay attention to it. Therefore, it is so important to try not to spoil your reputation.

Nevertheless, if the credit history is already damaged, there is a chance to fix it. But it should be borne in mind that this is a rather lengthy process that will require a lot of effort from the borrower.

In conclusion, we recommend watching a video on how to check and correct a credit history:

That’s all with us.

We wish readers of the financial magazine Rich Pro that your credit history be positive. If it is bad, we hope that you will be able to fix it quickly and easily.

If you have any questions, comments or additions on this topic, then write them in the comments below. We will also be grateful if you share the article with your friends in social networks. See you soon!